Wealth far outpaces debt as a society, which, at the very least seems to lend credence to the idea that debt, or at least government debt, isn't a problem.

It does have consequences that are arguably problems....

- Inflation, which taxes phantom gain, ie, income &

capital gains due solely to currency devaluation.

Government calls this good cuz it gets tax revenue.

Taxpayers call it bad cuz they pay tax on money that

isn't income at all.

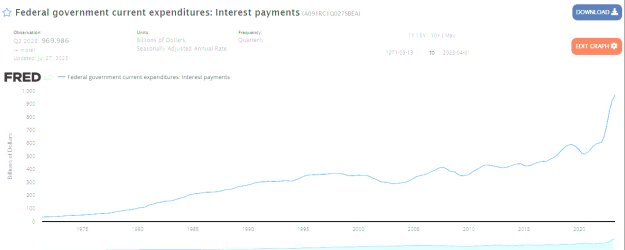

- It increases interest rates by competition for money,

& by reducing government's credit rating.

- It drives speculative home buying as a hedge against

inflation. Rising prices mean more income for government

by transfer & capital gains taxes.

Isn't that how any company would measure it's success, debt-assets?

No.

ROI is far better.

Equity ratio is a measure of stability.

That said, I agree there are a number of problems in our system of governance and, as I said, in the distribution of wealth, but debt as thing unto itself isn't a problem.

The disagreement is over

just what a "problem" is.

Of course that accounts for some, the other likely more significant cause is a culture where companies and individuals that values profits above everything else, even the well-being of others.

For example, my Grandmother lives in a double wide trailer in the trailer park she lived in throughout most of my life. A hedge fund (equity firm) realized they could buy the park and raise rents each year aggressively to the point that people can on longer afford to live there (as most or lower income or retired). At which point people are evicted and told to remove their trailers, some of which have been there for decades and couldn't move even if people had the money to move them.

Markets change. Something cheap has become more valuable.

Those who rent have no equity, so they should realize that what

they pay will change with the market.

It doesn't matter whether the owner is a hedge fund or a person.

Both will seek the highest & best use for their property.

Of course this was the plan. The hedge fund knew that the majority of people wouldn't be able to save their trailers and the parks new owners would simply assume ownership of the abandon trailers (after sneaking new language into the lease agreements after taking ownership).

If there is a breach of contract or fraud,

the remedy is easy & effective, ie, court.

That's just one simple anecdotal example of how people with money seize the property of others through legal means because profit motive is, culturally, increasingly the most important thing and those seeking profits can rationalize immoral and unjust behavior because they have the right to seek profits.

Sounds like you just don't want anyone

being wealthy, running businesses, &

increasing prices.

Even ownership doesn't protect us from

inflation....government sometimes hits us

with huge property tax increases.